Blockchain technology will change your life – world without middlemen

World is running so fast you can’t even imagine what technology can do. A man can change the world with his ideology which makes him perfect and unique from other and I’m sure that’s so many people didn’t aware about Bitcoin and Blockchain.

First of all let me tell you about Bitcoin, which is also called Cryptocurrency which means people can send or exchange money electronically as easily by sending email or text by using the app called a wallet.

Bitcoin was created by Satoshi Nakamoto, Who publishes the invention on 31st Oct 2008 to a cryptography mailing list in research paper called Bitcoin (“A peer-to-peer Electronic cash system”)

It was invented by an unknown Programmer, or group of the programmer, under the name Satoshi Nakamoto. In January 2009 it was released and Nakamoto implemented Bitcoin as Open Source code.

In January 2009, the Bitcoin network came into existence with the release of the first open-source Bitcoin client and the issuance of the first bitcoins, with Satoshi Nakamoto mining the first block of bitcoins ever (known as the genesis block), which had a reward of 50 Bitcoins.

When it was invented the value was basically none and the first Bitcoin transaction was negotiated by an individual on the bitcointalk forums with one notable transaction of 10,000 Bitcoin Used to purchase two pizzas delivered by Papa Johns.

After 2010, the Graph of Bitcoin increased

| Date | USD:1 BTC |

| Jan2009 –march 2010 | Basically None |

| APR 2010 | $0.003 |

| May 2010 | less than $0.01 |

| July 2010 | $0.08 |

And Now you can’t even imagine the current rate of 1 Bitcoin

| May-June 2017 | $2000-$3000 |

The price reached its maximum in the history of Bitcoin. Now you can imagine the cost of two pizza, which was purchased by 10,000 bitcoin.

The system is peer-to-peer, and transactions take place between users directly, without an intermediary. These transactions are verified by network nodes and recorded in a public distributed ledger called a Blockchain. Since the system works without a central repository or single administrator, Bitcoin is called the first decentralized digital currency.

Besides being created as a reward for mining, Bitcoin can be exchanged for other currencies, products, and services in legal or black markets.

While doing Bitcoin transaction its need signature of recipients which is based on maths rather than handwriting. The maths comes from the world of cryptography, which is normally used to hide secret messages. But Bit client has been repurposed to prove ownership, each Bit client has associated key which they used to create the signature by encrypting transaction message to others test the signature by trying to decrypt. If a message was decrypted then the signature was created by the true account holder. Which prevents you from theft.

As of February 2015, over 100,000 merchants and vendors accepted Bitcoin as payment. According to research produced by Cambridge University in 2017, there are 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using Bitcoin.

Let’s talk about the Blockchain, it is trending topic on social media these days.

Blockchain plays very important role in the transformation of Bitcoin From one person to another. It was first introduced by Satoshi Nakamoto in 2008, where it serves as the public ledger for all transaction.

The main motive of this Blockchain for Bitcoin to solve the double spending problem without requiring a trusted administrator and modification of previous transaction records.

When it was introduced by Satoshi Nakamoto word Blockchain were used separately when it becomes popular it becomes Single Word in 2016, the file size of Block chain increasing yearly. In 2014 its size was 20 gigabytes and in January 2015 the size of the file become 30 gigabytes and from January 2016 to 2017 the size Of blockchain Increase from 50 to 100 gigabytes.

Each node in the Bitcoin network stores its own copy of the Blockchain containing only block validated by that node. Every block contains a record of all the recent Digital transaction.

When several nodes all have the same blocks in their Blockchain, they are considered to be in consensus. The validation rules these nodes follow to maintain consensus are called consensus rules. This section describes many of the consensus rules used by Bitcoin Core.

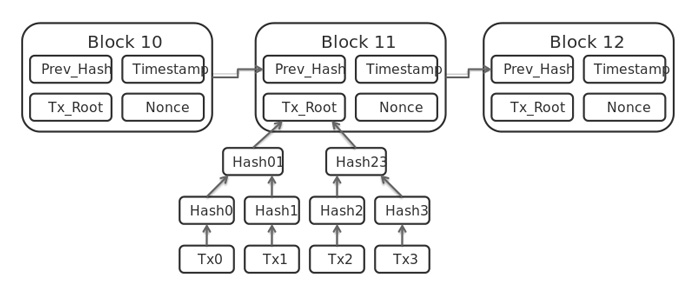

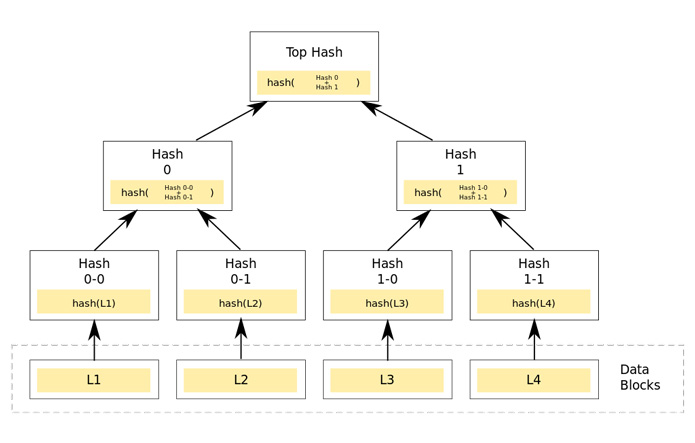

A block of one or more new transactions is collected into the transaction data part of a block. Copies of each transaction are hashed, and the hashes are then paired, hashed, paired again, and hashed again until a single hash remains, the Merkle root of a Merkle tree.

The Merkle root is stored in the block header. Each block also stores the hash of the previous block’s header, chaining the blocks together. This ensures a transaction cannot be modified without modifying the block that records it and all following blocks.

Transactions are also chained together. Bitcoin wallet software gives the impression that satoshis are sent from and to wallets, but bitcoins really move from transaction to transaction. Each transaction spends the satoshis previously received in one or more earlier transactions, so the input of one transaction is the output of a previous transaction.

A single transaction can create multiple outputs, as would be the case when sending to multiple addresses, but each output of a particular transaction can only be used as an input once in the block chain. Any subsequent reference is a forbidden double spend—an attempt to spend the same satoshis twice.

Outputs are tied to transaction identifiers (TXIDs), which are the hashes of signed transactions.

Because each output of a particular transaction can only be spent once, the outputs of all transactions included in the Blockchain can be categorized as either Unspent Transaction Outputs (UTXOs) or spent transaction outputs. For a payment to be valid, it must only use UTXOs as inputs.

Ignoring coin base transactions (described later), if the value of a transaction’s outputs exceed its inputs, the transaction will be rejected—but if the inputs exceed the value of the outputs, any difference in value may be claimed as a transaction fee by the Bitcoin miner who creates the block containing that transaction. For example, in the illustration above, each transaction spends 10,000 satoshis fewer than it receives from its combined inputs, effectively paying a 10,000 Satoshi transaction fee.

A Blockchain is collectively maintained by “miners”, who are members of the network that compete to validate Bitcoin transactions in each block by solving the complex algorithmic problem associated with the block.

They do this by buying or renting lots of computing power to run these complex algorithmic problems on. The incentive for them to use their computing power to verify transactions is that they are rewarded with Bitcoin if they solve the problem and validate a Bitcoin block.

The power of such a decentralized network is that economic value and governance are distributed among the network’s stakeholders (i.e. miners and consumers) rather than concentrated in a single organization (e.g. banks, governments & accountants). Thanks to this setup, anyone can own and transfer assets digitally without the need for a third party.

Blockchain technology isn’t limited to Bitcoin. It can be used to create any other cryptocurrency, such as Ethereum and Litecoin, which utilize their own Blockchains.

The Blockchain is collaboratively maintained by anonymous peers on the network, so Bitcoin requires that each block proves a significant amount of work was invested in its creation to ensure that untrustworthy peers who want to modify past blocks have to work harder than honest peers who only want to add new blocks to the Blockchain.

Chaining blocks together make it impossible to modify transactions included in any block without modifying all following blocks. As a result, the cost to modify particular block increases with every new block added to the Blockchain, magnifying the effect of the proof of work.

The proof of work used in Bitcoin takes advantage of the apparently random nature of cryptographic hashes. A good cryptographic hash algorithm converts arbitrary data into a seemingly-random number. If the data is modified in any way and the hash re-run, a new seemingly-random number is produced, so there is no way to modify the data to make the hash number predictable.

To prove you did some extra work to create a block, you must create a hash of the block header which does not exceed a certain value. For example, if the maximum possible hash value is 2256 − 1, you can prove that you tried up to two combinations by producing a hash value less than 2255.

In the example given above, you will produce a successful hash on average every other try. You can even estimate the probability that a given hash attempt will generate a number below the target threshold. Bitcoin assumes a linear probability that the lower it makes the target threshold, the more hash attempts (on average) will need to be tried.

New blocks will only be added to the Blockchain if their hash is at least as challenging as a difficulty value expected by the consensus protocol. Every 2,016 blocks, the network uses timestamps stored in each block header to calculate the number of seconds elapsed between generation of the first and last of those last 2,016 blocks. The ideal value is 1,209,600 seconds (two weeks).

If it took fewer than two weeks to generate the 2,016 blocks, the expected difficulty value is increased proportionally (by as much as 300%) so that the next 2,016 blocks should take exactly two weeks to generate if hashes are checked at the same rate.

If it took more than two weeks to generate the blocks, the expected difficulty value is decreased proportionally (by as much as 75%) for the same reason.

(Note: an off-by-one error in the Bitcoin Core implementation causes the difficulty to be updated every 2,016 blocks using time stamps from only 2,015 blocks, creating a slight skew.)

Because each block header must hash to a value below the target threshold, and because each block is linked to the block that preceded it, it requires (on average) as much hashing power to propagate a modified block as the entire Bitcoin network expanded between the time the original block was created and the present time. Only if you acquired a majority of the network’s hashing power could you reliably execute such a 51 percent attack against transaction history (although it should be noted, that even less than 50% of the hashing power still has a good chance of performing such attacks).

The block header provides several easy-to-modify fields, such as a dedicated nonce field, so obtaining new hashes doesn’t require waiting for new transactions. Also, only the 80-byte block header is hashed for proof-of-work, so including a large volume of transaction data in a block does not slow down hashing with extra I/O, and adding additional transaction data only requires the recalculation of the ancestor hashes in the Merkle tree.

The Blockchain and Bitcoin are most complicated subject and I tried my best to provide you excellent knowledge in this article and confusion about these topics are clear now.

Now you will get the idea about cryptocurrency and Blockchain the complexity of these two is like watching star from the earth and trying to take self with the moon but good for our future now you can see the modernization how the world is changing.

Further Reading:

- 5 Best Platforms To Buy Cryptocurrency In India

- How To Buy Shiba Inu Coin In India?

- How to Buy and Sell Bitcoin in India

- 3 ways to earn Money from BLOCKCHAIN technology

If you liked this article, then please subscribe to our YouTube Channel. You can also search for the latest tech news and follow us on Twitter, Facebook, and LinkedIn