With the increasing awareness among the new generation and initiatives taken by many, ESG has become important for business owners to contribute to sustainability to increase their share value. ESG – Environmental, Social, and Governance is a company’s initiative to create a system that serves the society and creates a better future. Recently, many organizations have been taking steps to improve their social and environmental blueprint. Companies are striving to create favorable results for the environment and leave a kinder legacy for the future generations.

While ESG is a non-financial, ethical operation, it is used to measure a company’s performance and its carbon footprint. With the rise in global tragedies due, to man-made or natural, environmental and social consciousness is gradually becoming the new norm. Essentially, ESG portrays the belief system of a company, ultimately leading to achieved financial goals.

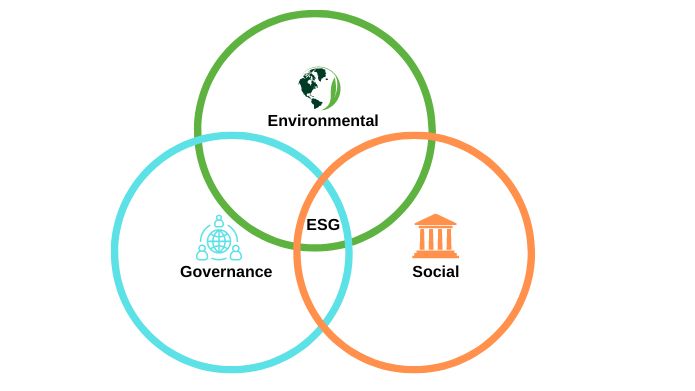

Environmental, Social, and Governance are the pillars on which ESG as a term stands. Let’s talk about them individually.

- Environmental: The direct impact that the actions of any organization have on the natural resources or the course of nature comes under the environmental factor. This includes, but is not limited to, climate change, gas emissions, pollution, waste production, and energy use. Contributing to deforestation and depletion of natural resources comes under this pillar.

- Social: Many companies mention their inclusive and equal work environment in their job postings. This is another ESG act that comes under the social pillar. Social responsibility factors and undertakings to promote social issues are included in this pillar. Other factors include animal testing, employee and human rights, employee and consumer safety, product liability, etc.

- Governance: Governance is an internal factor that determines the value of the company based on how they treat its employees and its corporate behavior. Diversity too comes under this pillar. It also includes how and what remuneration the employees receive, fraud, taxes and returns, corruption, employee and stakeholder rights, etc.

A company can choose to focus on one aspect at a time as per the company’s goals and industry outlook. Companies don’t need to invest in all the pillars at the same time; they can start small and eventually delve into the rest. However, it is important to note the significance ESG holds in attracting investors.

Why is ESG an important investment today?

Before ESG became a significant term, businesses initiated CSR activities to show their social support. Although they fall into the same category, many consider ESG as a branch of CSR. The difference between these is CSR focuses on the quality of the values held by a company.

In addition to this, COVID-19 pandemic has brought a huge focus on ESG factors among investors and businesses. As it accelerates the trend for a more sustainable approach to investing.

The post-pandemic investment landscape shifted towards the greater emphasis on ESG considerations. Investors are recognizing the potential financial benefits of investing in companies with strong ESG practices, such as reduced risk and increased resilience to future crises.

Here are few examples of ESG practices that companies can adopt to promote sustainability, responsible business practices, and long-term value creation:

- Environmental:

- Reducing greenhouse gas emissions

- Conserving natural resources

- Using renewable energy sources

- Implementing sustainable supply chain management practices

- Managing waste and pollution

- Promoting environmental stewardship

- Social:

- Embracing employee diversity and inclusion

- Creating a safe and healthy work environment

- Supporting human rights and fair labor practices

- Encouraging community involvement and philanthropy

- Supporting customer privacy and data protection

- Promoting consumer health and safety

- Governance:

- Promoting ethical and transparent governance practices

- Having a diverse and independent board of directors

- Effective risk management

- Strong accountability mechanisms

- Ensuring executive compensation is aligned with long-term value creation

- Avoiding conflicts of interest and promoting business ethics

ESG is thus becoming an important aspect for investors.

Companies can have a massive impact on how the world functions. Here, ESG becomes a corporate promise to create a better environment for the people. When businesses choose to consciously make efforts, they make people happy. Simple. Keep in mind that “making people happy” is not just about social acceptance.

Stakeholders are well aware of the benefits of ESG investment. As per a survey report by McKinsey, there are five key ways to generate value through the ESG approach. Not only do these methods can spur the company’s growth, but also boost sales. A business can reduce its cost and get more ROI by accessing efficient resources.

Furthermore, the report talked about how the companies can build greater relations with the community and the government of their country. This investment is also a great marketing strategy that can strengthen your company’s external and internal image. Creating a motivational environment for the employees can improve the employee turnover ratio. Moreover, a company dedicated to a cause can attract good resumes.

However, there is no one-size-fits-all solution when it comes to ESG planning. Each business can customize its approach and employ what works best for them. Companies like Disney, Alphabet, and Microsoft have already begun the process of becoming carbon-neutral organizations. Many others are following in their steps and some are setting decarbonizing goals for themselves. As per economic times, Indian companies like Vedanta, and Adani Transmissions, are planning to go net zero by 2050.

Many small business owners are starting with their set ESG goals in mind. The boom in the organic industry is the result of new founders smartly marketing their products and services.

How you can integrate ESG into your processes to improve your rating?

It is essential to set goals and tailor your ESG approach. Understand what positive impact your business can bring to the world, analyze internal capacities, and formulate strategies. Determine the amount of time it will require for your business to incorporate the strategies and derive acknowledgment. Additionally, involve the key players to have a greater impact.

When the CEO of a company talks about saving polar bears, it motivates the employees and customers to take part in the initiative. What this means is that higher management has the power to make or break your ESG ratings with their level of involvement.

It is equally important to have a dedicated team in place to constantly measure the results and steadily drive the plan of action. This team will be equipped to build an ESG framework and will work as per the company’s beliefs and vision. They will also ensure the accumulation of the right data to carry the processes further.

R&D processes play a crucial role in building ESG strategies. Analyzing the market, gathering relevant data, connecting with the right people to get their testimonials, etc. are important factors that need to be worked on before diving into a plan.

Getting your external and internal team on board with the idea is another important aspect. Remember that you are doing this with the community, therefore a helping hand of your resources and assets will be beneficial to the processes. Educate, inform, and get feedback!

Lastly, keep updating your plans and strategies. With changing times and corporate situations, single strategy can’t work for years. For constant growth, only changes need to be constant in your strategies.

Getting an expert to guide you through the process is another way you can ensure positive results.

You might question if ESG will work for you or not.

There is a possibility of the strategies not aligning with the bigger purpose of your organization. Do not fret for there are other ways you can be socially responsible.

Corporate Social Responsibility, Socially Responsible Investing, Impact Investing, and Conscious Capitalism are some of the ways to ensure you are making an impact in the community, but more on these later.

ESG across the Globe

The earliest ESG initiative was supported by the United Nations. In 2006 a framework called PRI(Principles for Responsible Investment) was launched with guidelines as per the ESG proposition. Many asset owners signed to promote the principles and ESG investment across various industries.

UN also set 17 development goals in place that targeted social, environmental, and economic factors. In 2015, the member countries proposed to achieve them by 2030.

To promote sustainable actions, the EU proposed an action plan that aims to promote sustainable investment and control the depletion of natural resources. A few other regulations to look out for are EU SFDR and Taxonomy.

Many companies are also taking responsibility for their actions and working towards creating a better world, as we discussed earlier. IBD, in 2022, released a list of global companies with high ESG ratings. 100 companies made this list and were recognized as profitable stock to look out for. The financial growth of these companies has witnessed the exceptional effect of ESG strategizing.

With Europe investing heavily in the ESG market, there are hidden promises of the ROI increasing further. India too is investing in being environmentally and socially conscious.

Indian ESG initiatives

India, as a part of the Paris agreement, pledged to reduce its greenhouse gas emissions. As per Fortune India, the inbound ESG investments are bound to rise by 90% in the coming times. Moreover, the Board of Directors has to submit a detailed report of their energy conservation under the Indian Companies Act.

On the other hand, Indian companies are taking various steps as their ESG responsibility. Havells, a well-known lighting and electronics brand, removed the Kr-85 isotope from its lighting range. Other products of the brand, too, are free of any kind of radioactive materials.

P&G introduced recyclable bottles that contain ocean plastic and 90% consumer-used plastic. Maruti Suzuki awards underprivileged students with scholarships and has adopted institutions like ITI and JIM to promote education for all. Other companies with a high ESG score include Dabur India, Asian Paints, J K Cements, Eicher Motors, and Godrej Consumer, among others.

Future outlook and opportunities for ESG

2023 is looking at zero emissions, employee welfare, and data security as the major themes of ESG propositions.

The world has witnessed many crises since the start of the global pandemic. This has led to people becoming more conscious and expecting businesses to do the same. Let’s look at what the future of ESG investment holds.

- Increased standardization and transparency: There is a growing need for standardization and transparency in ESG reporting and disclosures. As a result, we may see more regulatory bodies and industry groups establishing guidelines and frameworks to ensure consistency and accuracy in ESG data.

- Expansion of ESG integration across asset classes: ESG integration has historically been focused on equities, but we are starting to see more interest in integrating ESG considerations into other asset classes, such as fixed income and real estate.

- The emergence of new ESG products: The demand for ESG products is expected to continue to grow, leading to the development of new investment products and strategies, such as ESG-themed ETFs and impact investing vehicles.

- Greater emphasis on social and governance factors: While environmental factors have dominated the ESG landscape thus far, there is increasing recognition of the importance of social and governance factors. As a result, we may see more investors focusing on issues such as diversity and inclusion, human rights, and executive compensation.

- Use of technology and data analytics: Technology and data analytics are playing an increasingly important role in ESG investing, helping investors to identify risks and opportunities, track progress, and measure impact.

With the increase in business investment in ESG, the opportunities will also see a boom.

The demand for ESG analysts and experts will increase as businesses will require a skilled team to look at promising strategies. We may also see ESG considerations being integrated across a wider range of investment products and asset classes, which could create new opportunities for ESG professionals in areas such as fixed income, private equity, and real estate.

Additionally, job opportunities in areas such as diversity and inclusion, human rights, and executive compensation will increase due to the recognition of governance factors. Technology and data analytics are increasingly being used to analyze ESG data, which could create new job opportunities for data scientists, analysts, and other technology professionals.

Conclusion

In conclusion, ESG has emerged as an important consideration for businesses looking to improve their social, environmental, and governance impact. Companies that prioritize ESG not only contribute to a better world but also stand to benefit financially through increased investment, reduced costs, and improved brand image.

By taking a proactive approach towards ESG, businesses can not only mitigate negative impacts but also create a better future for all stakeholders. As we continue to face global challenges, businesses need to embrace their social and environmental responsibilities, and ESG provides a framework for doing so.